Asset-based financing is a way for rapidly growing companies to meet their short-term cash needs. Companies can tap their assets to generate cash flow through asset-based loans or through factoring.

When you apply for an asset-based loan, you pledge assets to secure a loan from a bank or a commercial finance company. You still own your assets but if you don’t make good on your payments, the lending institution can seize them.

Accounts receivable and inventory are common collateral but any asset might qualify. When you use accounts receivable to secure a loan, you can expect to get about 75 to 90 percent of the face value of your fresh invoices.

As with all commercial lending, rates are negotiable. Lenders will look at your customers’ credit record, how long you’ve been in business and whether your assets are liquid.

Accounts Receivable

Financing the growth of your business can be a challenge, especially during a rough economy. If your sales of products or services to commercial accounts have created a cash flow shortage in your business, then your company can benefit from accounts receivables financing services from Touchstone Finance & Leasing.

Accounts Receivable Factoring

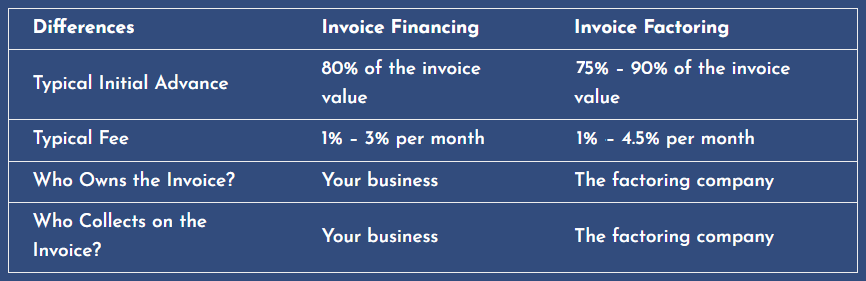

If your business provides a product or service to other businesses (B2B) and uses invoices to collect payments, it might be eligible for invoice factoring. With this type of financing, your business sells its outstanding B2B invoices to a third party. The factoring company buying your invoices might advance 70% to 95% of their total value upfront. From there, the company collects the outstanding payments from your customers, deducts a small factor fee (typically 0.5% to 5% per month, per outstanding invoice), and returns the balance to you.

Advantages and Disadvantages of Invoice Factoring

Invoice factoring can help your business access cash on outstanding invoices before they are due. Qualifying for this type of financing is often easier than qualifying for other types of business loans. The factoring company may review the credit of your customers during the application process to make sure those businesses are likely to pay as agreed.

Accounts Receivable Financing

Invoice financing works a lot like invoice factoring. Yet with this business funding option, you don’t sell outstanding invoices to a third party. Instead, your invoices serve as collateral to help you secure a cash advance, often up to 80% of the value of your outstanding invoices.

With invoice financing, you stay in charge of collecting from your customers. When your customers pay you, you repay the lender that issued you the advance.

Advantages and Disadvantages of Invoice Financing

When you back a loan using your invoices as collateral, your customers aren’t aware. Invoice financing can be somewhat expensive.

Invoice factoring vs invoice financing summary: