Supply Chain Finance

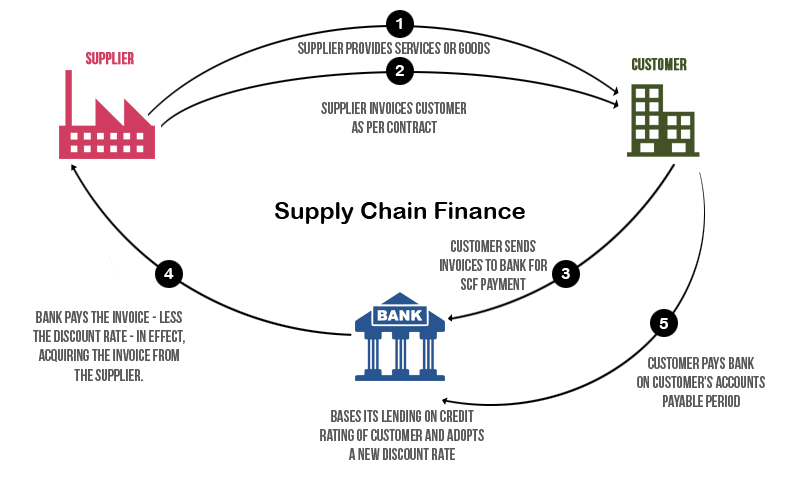

Supply chain is the flow of goods and services towards the end customer and the flow of money from the customer back up the chain to the supplier. Supply chain finance (SCF) refers to the techniques and practices used by banks and other financial institutions to manage the capital invested into the supply chain and reduce risk for the parties involved.

Supply chain finance (SCF) is a set of technology-based solutions that aim to lower financing costs and improve business efficiency for buyers and sellers linked in a sales transaction. Let’s delve into the details:

- Automated Transactions and Tracking:

- SCF methodologies work by automating transactions and tracking invoice approval and settlement processes from initiation to completion.

- Buyers agree to approve their suppliers’ invoices for financing by a bank or other outside financier (often referred to as “factors”).

- By providing short-term credit, SCF optimizes working capital and provides liquidity to both parties.

- Advantages for All Participants:

- Suppliers gain quicker access to money they are owed.

- Buyers get more time to pay off their balances.

- Both parties can use the cash on hand for other projects, keeping their respective operations running smoothly.

- How SCF Works:

- SCF works best when the buyer has a better credit rating than the seller.

- Buyers can access capital at a lower cost from a bank or financial provider.

- This advantage allows buyers to negotiate better terms with the seller, such as extended payment schedules.

- Meanwhile, the seller can unload its products more quickly, receiving immediate payment from the intermediary financing body.

- The financial institution pays the Supplier and extends the payment period for the Buyer, resulting in a total credit term of 60 days instead of the usual 30 days mandated by the Supplier.

In summary, SCF provides a win-win situation by enhancing liquidity, improving efficiency, and fostering collaboration in supply chains.