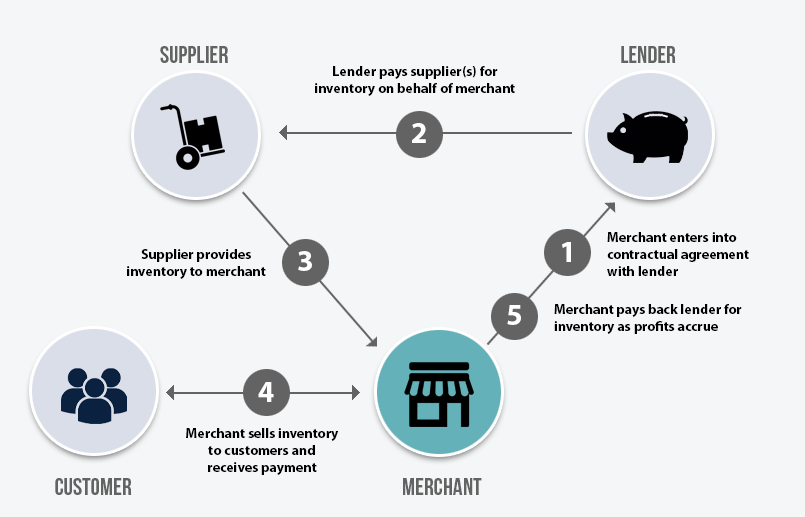

Inventory Financing

How Inventory Financing Works

Why is Inventory financing necessary?

As the owner of any business that sells physical products, you can probably think of a few situations where it would be advantageous to have more cash on hand to buy inventory. Perhaps you’re gearing up to expand sales at your brick-and-mortar location(s) and need financing to stock the shelves. Or, maybe one of your suppliers is offering a temporary sale on one of your top-performing products, which could mean massive savings if you are able to quickly buy in bulk.

Touchstone Finance & Leasing has helped 1,000’s of clients satisfy this need by providing essential inventory financing. The typical inventory loan will be based on 60% to 80% of the value at cost of your inventory.

International Trade Finance

- International trade finance is like a financial superhero that helps businesses buy and sell stuff across borders.

- Imagine you run a company that sells delicious mangoes. You want to send your mangoes to customers in different countries. But there are risks, like not getting paid or losing money due to currency changes.

- That’s where trade finance steps in! It’s like a safety net that ensures smooth

transactions between you (the seller) and your customers (the buyers).

How Does It Work?

- Banks and financial institutions play a key role. They offer tools like:

- Letters of Credit (LC): Think of it as a promise from the buyer’s bank to pay you once you ship the mangoes. It’s like a guarantee!

- Factoring: You get paid based on your outstanding invoices. So, even if your customer hasn’t paid yet, you’re covered.

- Insurance: Protects you from non-payment or shipping mishaps

- These tools make sure everyone plays fair, and the mangoes ( or any goods) move smoothly from one country to another.

Why Is It Important?

- Global trade relies heavily on trade finance. Around 80% to 90% of world trade uses it!

- Without trade finance, businesses would hesitate to trade internationally due to risks.

- So, next time you enjoy a juicy mango from another country, remember that trade finance made it happen!